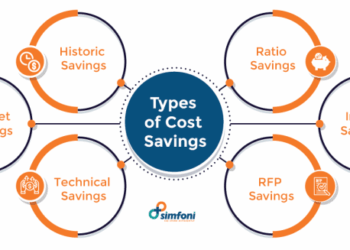

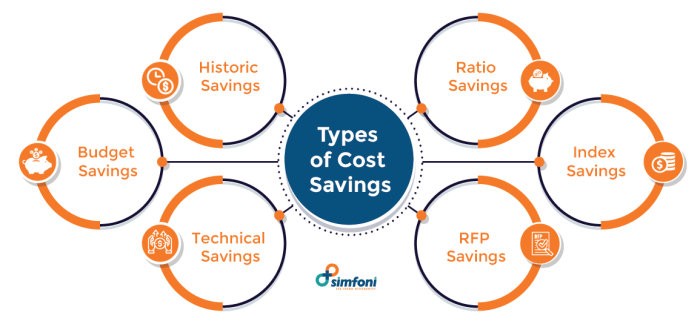

Exploring cost-saving tips, this introduction delves into innovative ways to reduce expenses, strategies to cut costs without compromising quality, and the importance of budgeting for long-term financial stability. It aims to provide readers with practical insights and actionable advice on managing their finances effectively.

Cost Saving Tips

Looking for ways to save money in your everyday life? Here are some innovative tips to help you reduce expenses without compromising on quality while emphasizing the importance of budgeting for long-term financial stability.

1. Meal Planning and Cooking at Home

One effective way to cut costs is by planning your meals ahead of time and cooking at home. This not only helps you save money on dining out but also allows you to control the ingredients and portions, leading to healthier choices.

- Make a weekly meal plan and grocery list to avoid impulse purchases.

- Cook in batches and freeze leftovers for quick, budget-friendly meals.

- Invest in kitchen essentials like a slow cooker or instant pot for easy and cost-effective cooking.

2. Energy Efficiency

Reducing your energy consumption can significantly lower your utility bills while also benefiting the environment. Implementing energy-efficient practices at home can lead to long-term savings.

- Switch to LED light bulbs and unplug electronics when not in use to save on electricity.

- Use programmable thermostats to regulate heating and cooling costs throughout the day.

- Seal windows and doors to prevent drafts and maintain optimal indoor temperatures.

3. Subscription Auditing

Reviewing your subscription services can reveal unnecessary expenses that can be eliminated or downsized. This simple audit can free up funds for more essential needs or savings.

- Cancel subscriptions you no longer use or need, such as streaming services or magazine subscriptions.

- Consider sharing subscriptions with family or friends to split costs without sacrificing access.

- Look for free alternatives or trial periods to test out new services before committing to paid subscriptions.

Saving on Utilities

When it comes to reducing your monthly expenses, saving on utilities can make a significant impact. By implementing some simple changes, you can lower your electricity, water, and heating bills, ultimately saving you money in the long run.

Comparing Energy-Efficient Appliances

Investing in energy-efficient appliances may require a higher upfront cost, but the long-term savings are worth it. These appliances are designed to consume less energy, resulting in lower utility bills over time. Consider comparing different models and their energy-saving benefits before making a purchase.

Impact of Small Changes

Small changes in your daily habits can also contribute to saving on utilities. For example, switching to LED bulbs can significantly reduce your electricity consumption. Additionally, adjusting your thermostat settings by just a few degrees can lead to noticeable savings on your heating bill.

These small adjustments can add up to significant savings over time.

Budget-Friendly Shopping

When it comes to saving money, budget-friendly shopping is key. By utilizing discounts, coupons, and deals, as well as buying in bulk and meal planning, you can significantly reduce your expenses.

Finding Discounts, Coupons, and Deals

One of the easiest ways to save money while shopping is by keeping an eye out for discounts, coupons, and deals. Many stores offer promotions and sales regularly, allowing you to purchase items at a lower price. Additionally, signing up for loyalty programs or newsletters can provide you with exclusive discounts and coupons that can further reduce your expenses.

Buying in Bulk

Buying in bulk is another effective way to save money on groceries and household items. When you purchase items in larger quantities, you often receive a discounted price per unit, resulting in overall savings. Just make sure to only buy items in bulk that you know you will use to avoid wastage.

Meal Planning for Savings

Meal planning can help you save money by reducing food waste and grocery expenses. By planning your meals in advance, you can create a shopping list based on what you actually need, preventing impulse purchases and unnecessary spending. Additionally, meal planning allows you to buy ingredients in the right quantities, avoiding spoilage and ensuring that everything you buy gets used efficiently.

Transportation Savings

When it comes to saving money on transportation, there are several strategies you can implement to reduce costs and maximize efficiency.

Cost-Effective Commuting

- Consider carpooling with colleagues or friends to share the cost of gas and reduce wear and tear on your vehicle.

- Utilize public transportation options like buses or trains, which can be more economical than driving yourself.

Maintaining a Fuel-Efficient Vehicle

- Regularly tune up your car to ensure it is running efficiently and using fuel optimally.

- Check tire pressure regularly to improve fuel efficiency and reduce the frequency of refueling.

Reducing Maintenance Costs

- Follow the manufacturer's recommended maintenance schedule to prevent costly repairs in the future.

- Compare prices at different auto repair shops to find the best deal on necessary services.

Final Review

In conclusion, the discussion on cost-saving tips highlights the significance of being mindful of expenses, making informed choices, and planning for a secure financial future. By implementing these tips, individuals can achieve a better balance between saving money and enjoying a fulfilling lifestyle.

FAQ

How can I reduce electricity bills effectively?

To reduce electricity bills, consider using energy-efficient appliances, unplugging devices when not in use, and utilizing natural light whenever possible.

Is buying in bulk always cost-effective?

Buying in bulk can be cost-effective for items you frequently use and have a long shelf life. However, it's important to compare prices and consider storage constraints.